Terms Conditions The. Annual car Roadtax price in Malaysia is calculated based on the components below.

For high power scooter their.

. Sedan Hatchback Coupe Wagon Convertible. Bigger engines pays more tax The price increase. Engine Capacity CC Please provide a valid informations.

The cheapest rate is 20 if you pay in one go. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. The calculation for motorcycle road tax follows the rate set by JPJ.

Latest JPJ formula - calculate how much your vehicles road tax will cost. Motor Vehicle License LKM rates calculation guidelines for Electric Vehicles in in the link. Why is it necessary.

If found driving without it you can be fined RM3000 according to Road Transportation Act 1987. We can see it has a base rate of RM380. Road Tax for Private Car and Motorcycle JPJ Road Tax for Electric Vehicle.

Latest JPJ formula - calculate how much your vehicles road tax will cost. Yes it is mandatory in Malaysia. Bjakmy Offers Instant Road Tax Renewal Car Insurance.

Import duty must be paid on any vehicles imported into Malaysia. Road tax for private car and motorcycle. You can only tax a 125cc motorcycle or scooter for 12 months so if youre unsure how long youre going to keep it its best to setup a Direct.

Car RoadTax Calculator Estimate Road Tax Engine Capacity CC Region Semenanjung Malaysia PeninsularSabah Sarawak Please Refer Here Road Tax is. Use this calculator to get your road tax rate to easily renew road tax. Learn how to calculate us.

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and. Motor vehicle license lkm rates. Bjakmy touted as Malaysias leading online auto insurance marketplace.

- New Straits Times. Your road tax amount. Total of progressive rates Base Rate RM7960 RM200 RM27960 And that is how you can calculate the amount of your road tax yourself.

Calculate your motor insurance amount Dapatkan jumlah pembayaran insurans motor anda. Based on the Private Cars in West Malaysia table it falls between 2001cc and 2500cc. Motor Vehicle License LKM Rates Calculation Guidelines.

Use our calculator to get an estimate of how much you will need to spend to get the coverage you. Harga Roadtax Motor Suzuki AG100 RM2 AN125 RM2 Belang 147cc RM2 FD110 RM2 RGV 249cc RM50 RU120 RM2 Scooter V100 124cc RM2 TXR150 147cc RM2. Aside from it being a legal obligation.

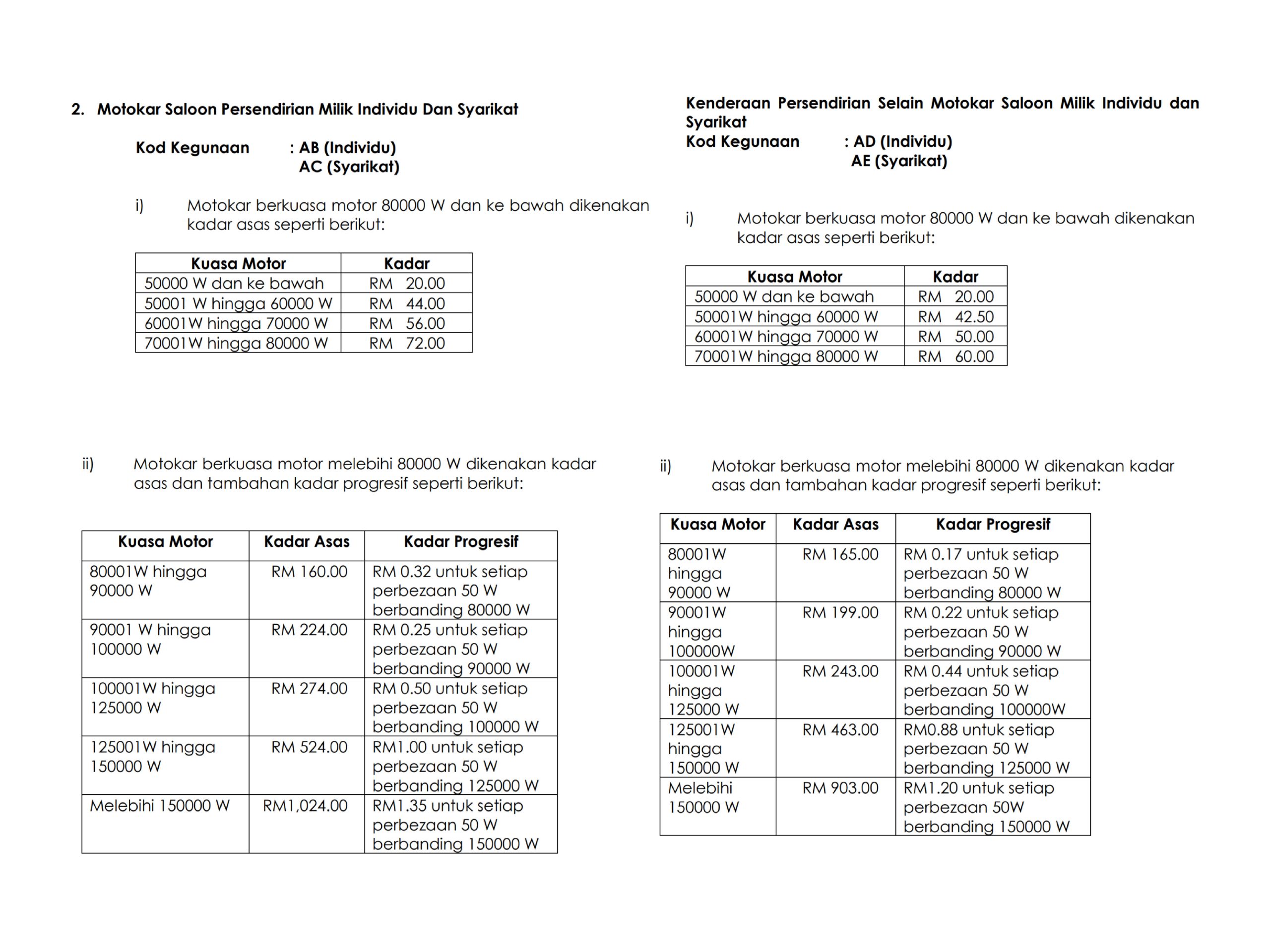

The electric cars which produce more than 80 kW of output the rates are - Electric motorbikes The road tax on electric motorcycles in Malaysia is fixed at RM 2 for vehicles. The road tax rate is calculated as follows starting with a base rate and an additional rate for each kW increase. To calculate the progressive rate we take the.

Roadtax Calculator Roadtax Calculator More Calculators Latest JPJ formula - calculate how much your vehicles road tax will cost. Road Tax MYR 000 Effective Jan 1st 2008. Engine displacement Cubic Capacity Liter.

Normally a scooter will have engine capacity ranging from 50cc 90cc 100cc and 125cc. Above 80 kW to 90 kW RM165 and RM017 sen for every 005 kW.

Motorcycle Road Tax Price Deals 51 Off Ilikepinga Com

Road Tax Calculator Carbase My

How Do You To Renew Your Insurance And Road Tax Online Wapcar

Renew Road Tax Malaysia Car Road Tax Calculator Fast Easy Malaysia

Malaysian Sample History Reports

No Time Purchase Renew Motorcycle Insurance Road Tax Online Now

Road Tax Calculator Renew Road Tax Online With Imotorbike From Rm14 Only

Malaysia Online Road Tax Calculator By Fincrew

Scout Rogue Indian Motorcycle White Plains Ny 10607

Motorcycle Road Tax And Insurance What Do You Pay Paultan Org

Car Motorcycle Road Tax Expired Over 3 Years How To Renew

Malaysia Online Road Tax Calculator By Fincrew

Toll Gas Calculator Tollguru Apps On Google Play

Grab Losses Widen To Almost 1 Billion As Pandemic Restrictions Drag Ride Hailing Business